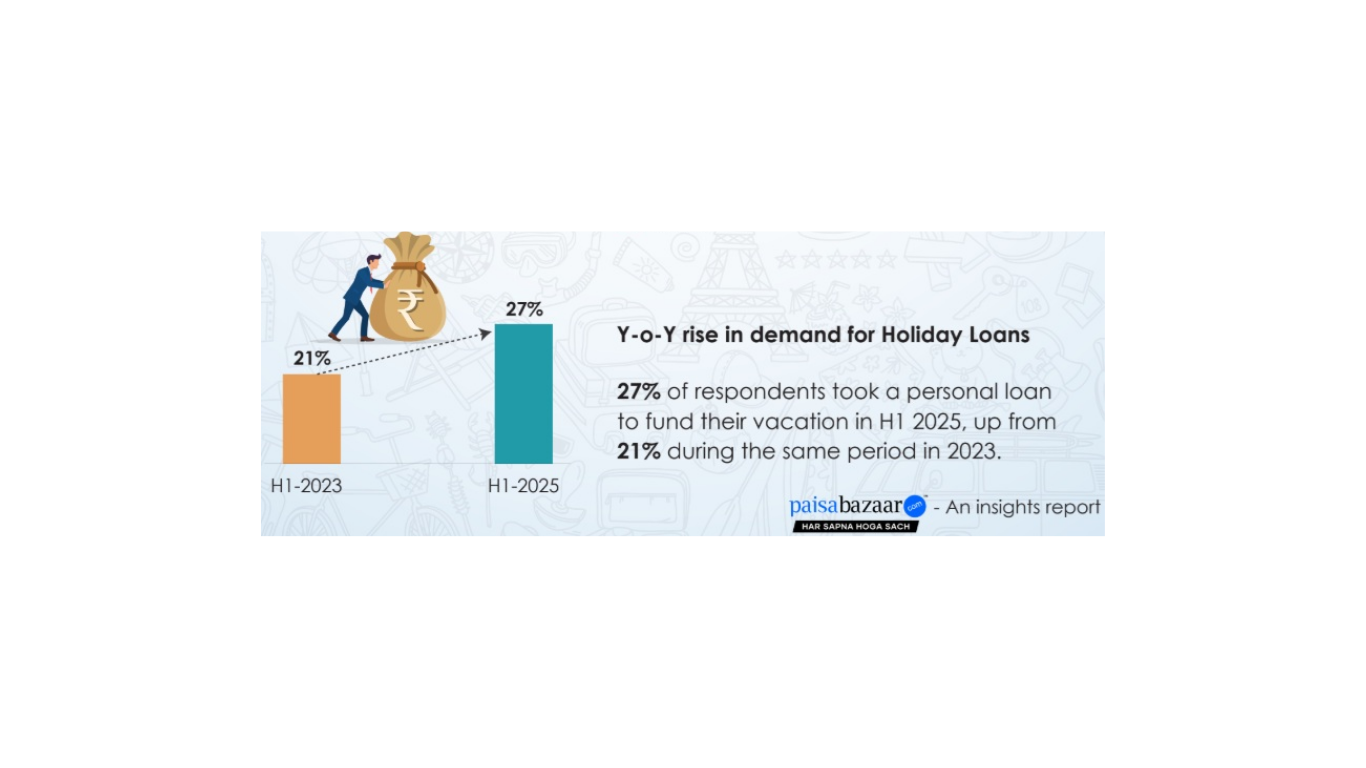

Personal loans are increasingly becoming a popular way to fund holidays, revealed a consumer insight report by Paisabazaar. According to the 2nd volume of “How India Travels Using Holiday Loans (Vol. 2.0)” – by Paisabazaar – 27% of borrowers who availed personal loans in the first half of 2025 from its platform used it for vacation purposes, up from 21% in 2023.

The insights report draws from a comprehensive survey of over 5,700 respondents across 97 cities and towns. The findings reveal some interesting insights, including a strong preference of Holiday Loans among non-metro consumers, with 71% of holiday loan borrowers coming from Tier-2 and Tier-3 cities, compared to just 29% from Tier-1 metros.

Santosh Agarwal, CEO, Paisabazaar, said “We are seeing consumers becoming increasingly comfortable and confident in using credit to meet aspirations and lifestyle needs, and the rise in holiday loans reflects this shift. With the second edition of our holiday loans report, we are happy to share insights into how different segments are financing their travel aspirations. At Paisabazaar, our goal is to empower all consumers with wide choice, transparent comparison and trusted advice to make informed credit decisions.”

According to the report, Gen Z borrowers (aged 28 or lower) also constituted a major portion of the borrowers in 2025, accounting for almost 30% of all Holiday Loan borrowers.

Key highlights of the report:

Rise in Demand for Holiday Loans H1 2025

· 27% of personal loan borrowers in H1 2025 used the loan for vacations, up from 21% in H1 2023.

· Vacations surpassed home renovations, which dropped from 31% in 2023 to 24% in 2025.

Tier-2 and Tier-3 Cities Drive Growth

· 71% of holiday loan borrowers in H1 2025 came from Tier-2 and Tier-3 cities, compared to 68% in H1 2023.

· Tier-1 city contribution fell from 32% to 29%.

· Key non-metro contributors: Lucknow, Surat, Jaipur, Patna, and Durgapur.

Delhi and Hyderabad Dominate Metro Demand

· Among Tier-1 cities, Delhi accounted for 35% of holiday loans, followed by Hyderabad at 18%.

· Mumbai (15%) and Bangalore (14%) also featured prominently, while Chennai, Kolkata, and Ahmedabad each accounted for 6%.

Young Borrowers Fueling the Surge

· Gen Z (aged 20–30) borrowers increased sharply from 14% in H1 2023 to 29% in H1 2025.

· Millennials (aged 30–40) remained the dominant group, contributing 47% in 2025.

Preference for Smaller Loan Amounts Increases

· 30% of holiday loans in 2025 were in the Rs. 1 to 3 lakh range, up from 13% in 2023.

· Loans between Rs. 50,000 to Rs. 1 lakh increased from 12% to 20%.

· Loans below Rs. 50,000 grew from 2% to 15%.

Private Salaried Segment Leads Borrowing

· Private salaried employees made up 65% of holiday loan borrowers in both years.

· The share of business owners rose from 12% in 2023 to 17% in 2025.

· Self-employed professionals (12%) and government employees (6%) followed.

Peak Loan Demand in January and Summer Months

· 60% of holiday loans were disbursed in January, May, and June of 2025.

· January alone accounted for 21% of disbursals.

Top Domestic and International Destinations

· Domestic: Goa was the most preferred destination (18%), followed by Kashmir (16%) and Himachal Pradesh (14%).

· International: South East Asia led with 44% preference, followed by the Middle East (32%),